Top Five Myths about the Canadian Technology Sector and Public Markets

2015 is now well underway and, like every new beginning, it gives us time to reflect on where we have been and what challenges and opportunities lie ahead.

Usually I start the New Year by providing an update on financing and new listing activity in the innovation sectors (comprised of the technology, clean technology & renewable energy and life sciences sectors) on Toronto Stock Exchange (TSX) and TSX Venture Exchange (TSXV).

This year, however, rather than simply presenting this information in point form, I assembled a list of the most common myths – or misunderstandings – about the public markets and the innovation sectors in Canada.

Listed below are the top five myths I see about our country’s leading public equities markets, TSX and TSXV, and the innovation sectors on the Exchanges:

Myth #1 – 2014 was a tough year to raise capital in Canada: Every sector and public company is subject to its own unique set of factors and conditions, but in 2014, there was a noteworthy increase in overall capital raising activity in Canada. In fact, $52.5 billion in equity capital was raised on TSX in 2014, an increase of 32% from 2013. On TSXV, our public venture marketplace, $5.2 billion in equity capital was raised, up 39% from 2013.

Myth #2 – The Canadian capital markets are small on a global scale: Actually, the Canadian equity market is one of the largest in the world and has an outsized impact for a country that is home to just over 35 million people. Since the start of 2012, more equity capital has been raised by companies listed on TSX and TSXV (combined) than by those listed on any of the major stock exchanges in London, Germany, Tokyo, Shanghai and Australia. Together, TSX and TSXV only trail the New York Stock Exchange (NYSE), NASDAQ and the Hong Kong Stock Exchange over this period.

Myth #3 – TSX and TSXV are dominated by mining and energy companies: The Exchanges are very proud to be home to some of the world’s leading natural resource companies (TSX and TSXV lead all other global exchanges by the number of listed companies and equity capital raised in the mining and oil & gas sectors). However, that said, mining and energy companies collectively represent just over 20% of the total market value of all the companies listed on TSX and TSXV as of the end of 2014. In other words, a lot of other sectors matter, including the innovation sectors (more on this below).

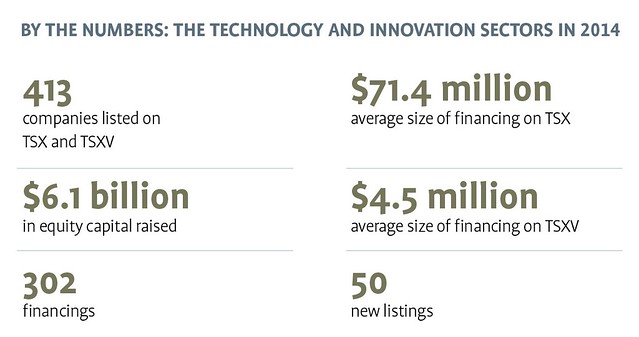

Myth #4 – Canada has not embraced innovation companies: In reality, the innovation sectors are the fastest-growing sectors on TSX and TSXV for two years running. When looking at 2014 specifically, these sectors rank #1 by the number of initial public offerings (IPOs) and new listings, either outpacing or matching other sectors such as mining and oil & gas. The aggregate market value of TSX- and TSXV-listed companies in the innovation sectors has also increased by over 110% since the start of 2013 – more than any other sector.

Myth #5 –Innovation companies do not go public in Canada: In 2014, 50 innovation companies went public on TSX and TSXV. This represents an IPO or new listing every seven business days, on average – again, more than any other sector on the Exchanges. The companies that have gone public include businesses at all stages of development from around the world. They also include businesses backed by some of the largest private equity and venture capital investors in North America.

The key takeaway from all of this is that the Canadian public equities markets have evolved significantly over the last few years, and this evolution has given innovation companies of all sizes new funding options. Investor appetite for good quality businesses has been strong recently and large and small-cap companies from Canada and around the world continue to look to TSX and TSXV to take their business or bright idea to the next level.

All data as of December 31, 2014.

This editorial is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies (collectively “TMX”) guarantees the completeness of the information contained herein. TMX is not responsible for any errors or omissions in, or your use of, or reliance on, the information we post or information accessed through links to any third party sites. TMX has not prepared, reviewed or updated the content of third parties on this site or the content of any third party sites, and assumes no responsibility for such information. Nothing in this blog is intended to provide investment, financial, tax, accounting, legal or other advice and you should not be relying on it for such advice. TMX does not endorse or recommend any securities referenced in this blog post. The information provided is not an invitation to purchase securities listed on Toronto Stock Exchange and/or TSX Venture Exchange. © 2015 TSX Inc. All rights reserved. Do not sell, distribute or modify any of the content or materials in this blog post without TMX’s prior written consent. Toronto Stock Exchange, TSX Venture Exchange, TSX and TSXV are trade-marks of TSX Inc.

This article was sponsored by TMX Group.