Here’s the Investor Deck I Used to Try and Raise $1 Million, and the Lessons I learned from It

I’ve always firmly believed that the best way to help entrepreneurs is to share honest and transparent experiences.

I’ve always firmly believed that the best way to help entrepreneurs is to share honest and transparent experiences.

For me, the best lessons are the ones learned by listening to other entrepreneurs as they relay candid stories about their successes and failures—not by reading their carefully crafted blog posts dolling out generic advice. Each story independently may not directly teach me something. But in aggregate I start to see patterns emerge. Parts of the stories that are relevant to my situation. That’s where the value is for me.

That’s why I was so impressed when Buffer shared their investment deck. I’ve wanted to do the same ever since. It was an honest insight into one part of fundraising.

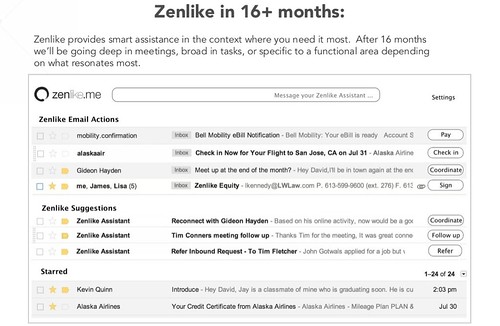

So below you’ll see the deck we used when pitching Zenlike during fundraising. It’s the long form version; the one I’d use over email as opposed to the one used in an actual meeting. I also included some lessons learned along the way. As per my rant above, the advice isn’t meant to be gospel. Just lessons that were applicable to our story.

(We were attempting to raise $1 million in a priced round and had several meetings with institutional investors such as First Round Capital, True Ventures, Cowboy Ventures, Mayfield, Mohr Davidow, iNovia, Google Ventures, XG, as well as angels such as Boris Wertz and David Tisch. The deck was well received but we ultimately failed at raising the million dollars. We had $500,000 soft committed but I decided to take an EIR role with SRI International instead.)

The lessons I learned:

1. Know who you’re pitching

Perhaps it goes without saying, but I’d adjust the deck based on the investors areas of focus, their other investments (which on occasion became interesting for the competition slide). It’s annoying and is a lot of work when you’re talking to so many investors, but it’s worth it. I still have about 40 versions of the deck on my hard drive.

Pro tip: Rename the folder the document lives in… not the document itself. It’s really embarrassing sending a file to a firm when it’s named after another firm.

2. Know that the deck will be shared

While I always tweaked the deck depending on who I was sharing it with, I also realized that it would be shared with other partners in the firm—or partners in other firms. Keep that in mind. This also meant that the deck needed to tell a good story even without my voiceover.

3. Be concise

The version of the deck above isn’t concise enough. I never found a way to do so without compromising the ability of someone reading it outside of a presentation to understand it. I did use a more concise version that relied more on visuals and much less on text when presenting in person.

4. Having it look professional helped

Our initial draft looked pretty terrible. Ken Bautista and Cam Linke at Startup Edmonton helped a ton with the cosmetics as well as content. Having it look sharp, crisp, and professional not only leaves a better impression with the investor—but it also made me much more confident when presenting. I hate to say it, but looks mattered. A lot.

5. The deck was a terrible tool for a first meeting.

Generally speaking, my first meetings with investors were over coffee or lunch. They were informal/get to know you/brainstorm the idea. I only used the deck in one of these meetings. And it caused the dialog to feel forced and ruining an otherwise casual, ad-hoc, natural and exploratory dialog.

6. It’s a decent tool for a second meeting.

I used the deck for about half of the meetings I had. In those meetings, the funding dialog had advanced to a point where there were items I wanted to make sure we touched on before the meeting ended. Having the deck helped make sure of that.

That said, the conversation ebbed and flowed naturally. But I could always use the deck to make sure we touched on a certain topic.

7. It’s an awesome tool for introductions.

Arguably the best use of the deck was to allow people making introductions to get up to speed with what I was doing very quickly. Most of my friends making introductions were already familiar with Zenlike, but if they weren’t, the deck was a pretty easy way to get them up to speed quickly. Having the deck also gave them something they could easily forward to see if an intro was welcome.

8. The competition slide was probably the most important one.

Often times the easiest way for people (myself included) to understand something, is to place it within a context they already understand. In the case of a competition slide, it not only helps people understand what your startup does, but it also tells a good story on how you’re different. Something that any investor will care a lot about. It took us a while but we found a way to layout our competition in a way that resonated a lot with investors.

9. Milestones slide was also hugely important.

I learned this the hard way. Over the years, I’ve become a massive fan of the lean startup. I’ve come to believe that startups are extremely uncertain and volatile, so any “plan” you have that goes beyond three months, is likely to become irrelevant. That was reflected in the first few versions of our milestones slide. But when you’re asking an investor to fund growth for 18 months, you need to have milestones absolutely nailed down. Even though startups evolve, you need a compelling working thesis as to where you’re going, and most importantly for an investor, what value they’ll have “purchased” with their investment. At the end of the day, your investors, especially at the seed stage, are betting that you can build incredible value with the money they give you. They want to see their “bet” pay off at the next round of funding.

And perhaps more than anything, the milestone slide lets investors see how big you might be thinking. Ideally they want to see aggression grounded in reality.