Latest Study Shows Online Banking is Finally Mainstream – but Mobile Still Has a Long Way to Go

In November 2011 a survey from ING Directsuggested that half of Canadian smartphone users will be banking from their mobile device within 24 months.

In November 2011 a survey from ING Directsuggested that half of Canadian smartphone users will be banking from their mobile device within 24 months.

It’s been more than two years and that adoption rate fell well short of ING’s hopes. A survey late last year pegged the number at 41%, up from 38% in 2012 and 35% in 2011.

Mobile banking may be very slow to gain fans, but online banking is at least now well established.

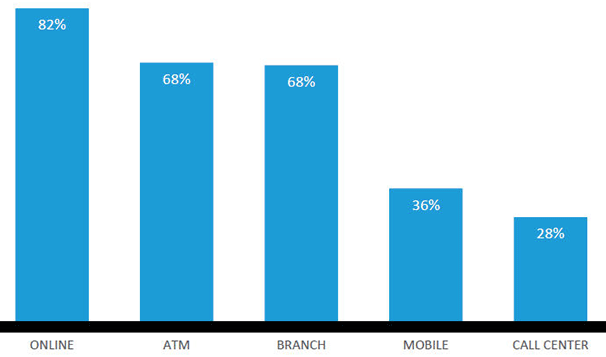

According to Nielsen data, 82% of consumers have entered the digital arena, stating that they banked online at least once in the last 30 days, compared to 68% of people who said they had visited a physical branch in the same period.

“Times are changing, and today’s digital world is having widespread effects on an array of consumer behaviours, including how we handle our finances,” says Nielsen. “Electronics and mobility are key trends for financial institutions to keep track of, but consumers aren’t ready to sever all ties with their local bank branches just yet.”

Nielsen describes mobile banking as “a distant preference” when compared not only with online banking, but even with traditional, physical channels. However, Nielsen acknowledges that it is “gaining momentum.”

“In today’s world, companies and brands need to be online. And that includes banks and financial firms,” says Nielsen. 77% of consumers say they prefer to pay their bills online. Mobile consumers prefer checking their account balances using their smartphones or tablets more than any other channel—but seem wary to engage in any further activity, even though it’s been proven just as secure as online banking.

Images: Nielsen