Venture Capital in Canada Reaches Highest Level in More Than a Decade

Venture capital investment in Canadian companies rose to a 13-year high in 2015, according to Canada’s Venture Capital & Private Equity Association.

Venture capital investment in Canadian companies rose to a 13-year high in 2015, according to Canada’s Venture Capital & Private Equity Association.

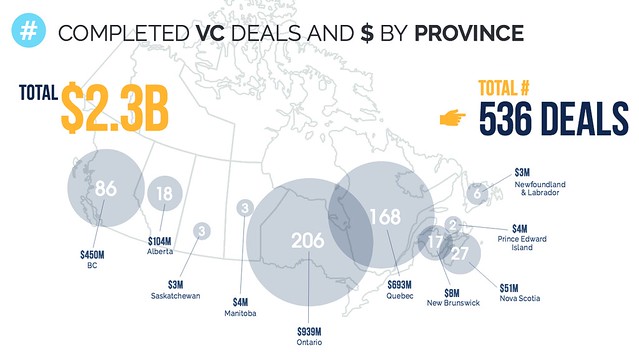

A total of $2.3 billion was invested in Canadian companies during the year, a 12 per cent increase from 2014, according to data released by the industry association on Monday. It’s highest level of investment recorded since 2002.

Those investments were spread out over 536 deals.

“Venture capital investment is going through a much needed resurgence in Canada,” Mike Woollatt, CEO of the CVCA, said in a release. ”The future looks brighter as exits climbed through 2015 and fundraising numbers were strong, thanks in large part to government activity on the fund of funds side.”

The increase in investments was largely driven by strong performance in Quebec. $693 million was invested in Quebec-based companies in 2015, up from $295 million the year before.

The largest deal of the year was also recorded in the province: $79 million raised by Montreal’s Lightspeed POS in September.

Ontario, though, continued to see the most activity. Companies in that province raised $939 million, a small increase from the $932 million raised the year before.

In British Columbia, the results were not as strong. There, investments declined from $554 million in 2014, to $450 million in 2015.

The majority of VC in Canada – almost $1.4 billion – went to information and communications technology companies.

Of that money, 54 per cent went to companies in the “internet software and services” business, while another 22 per cent went to e-commerce companies.

Exits were also up in 2015, increasing to $4.3 billion, from $1.5 billion in 2014 and $1.3 billion in 2013.

The biggest of those exits was Shopify’s $1.6 billion IPO.

Most of the money invested in 2015 went to early-stage companies and their share of the market appears to be growing. $1.16 billion was invested in early-stage companies in 2015, up from $794 the year before and $636 million in 2013.

Seed-stage investments were $154 million, up from $133 million in 2014 and $85 million 2013. Later stage financing, though, appears headed in the opposite direction. It fell to $530 million in 2015, down from $785 million in 2014 and $931 in 2013.

And this activity appears likely to continue. The CVCA says 30 venture funds raised $2 billion in 2015, up from $1.2 billion in 2014.