Wealthsimple Launches Automated Platform to Financial Advisors

Toronto’s Wealthsimple, an online investment service, has a launched an automated platform for financial advisors to manage their clients’ investment portfolios.

Toronto’s Wealthsimple, an online investment service, has a launched an automated platform for financial advisors to manage their clients’ investment portfolios.

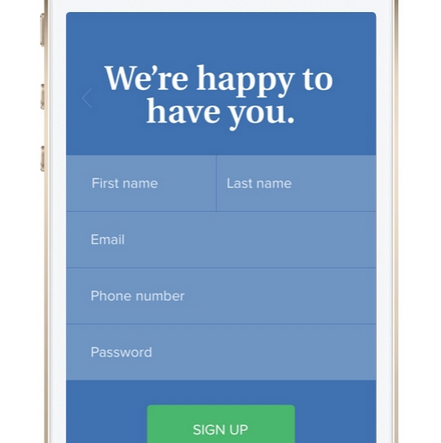

Wealthsimple for Advisors is a new, digital way for Canadian advisors to maintain their clients’ portfolios, while letting Wealthsimple help them with the investment management. The robo-advisor handles the entire signup, from KYC to assessing suitability – freeing up the advisor’s time to provide holistic financial planning advice to their clients.

RELATED: Wealthsimple Launches Portfolio Review to Give Investors Second Opinion

“It is crucial for the investment industry to innovate, and present advisors with the tools to help their clients become informed investors,” says CEO Michael Katchen. “We want to work with the industry to provide smart technology and support the advisor’s ability to deliver outstanding client experiences.”

Wealthsimple will take the first 0.35% of an advisors’ assets on the platform, but advisors are free to add their management fee.

Founded by a team of financial experts and technology entrepreneurs, Wealthsimple is currently registered and operating in every Canadian province and territory. Since launch, Wealthsimple has brought in more than $400M in assets under management with over 10,000 clients on the platform. Last month they were named to PayPal’s FinTech Five.

Online investment manager Wealthsimple has launched a

Online investment manager Wealthsimple has launched a  Toronto’s Wealthsimple has won a Webby Award, an international award honouring excellence on the Internet.

Toronto’s Wealthsimple has won a Webby Award, an international award honouring excellence on the Internet. Wealthsimple Financial has acquired Canadian ShareOwner Investments, an automated investment manager.

Wealthsimple Financial has acquired Canadian ShareOwner Investments, an automated investment manager. Opening an investment account sucks.

Opening an investment account sucks. Toronto’s Wealthsimple today announced it has entered into a partnership with Power Financial Corporation, through a wholly owned subsidiary.

Toronto’s Wealthsimple today announced it has entered into a partnership with Power Financial Corporation, through a wholly owned subsidiary. Online investment management platforms are exploding in the US and have already secured more than $3 billion in assets under management.

Online investment management platforms are exploding in the US and have already secured more than $3 billion in assets under management.