Why Crowdfunding Has the Potential to Be Incredibly Disruptive in Canada

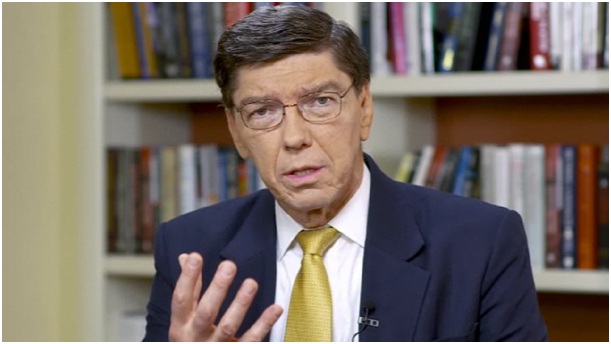

The author of innovation management bestsellers, such as Innovator’s Dilemma, and also a Harvard professor, Clayton Christensen believes crowdfunding is disruptive and “the next big thing in the investment industry.” In a recent Fortune interview, Christensen argues that crowdfunding can be disruptive depending on the business model and the target market.

“For now, as it takes root, I think that the disruptive crowdfunding opportunities are targeting non-consumptive areas—consumer being one,” he explains. “The sorts of opportunities that KickStarter targeted being another example. These are companies or projects that otherwise struggle to get funding. While I wouldn’t say that most entrepreneurs find it easy to get funding, there are certainly more people out there funding technology and healthcare companies than in other areas. So I think that crowdfunding platforms in those spaces (technology and healthcare) will find that they have a harder time (since they’re essentially taking on incumbent seed and angel investors), and face other complicated issues, like adverse selection (only go to the crowdfunders after they haven’t been able to get well-known angels or angel groups to invest).”

Thus, crowdfunding is growing first in underserved areas where traditional financiers have traditionally found unattractive. “This is a classic entry point for disruption: expand participation in the market by lowering cost at the low end of the market, where incumbents don’t see profit opportunities,” Clayton says. “Later, as the platforms gain scale, then they may start to add scope, or may start to add later-stage funding opportunities. That’s likely where all of this goes next.”

In May, Christensen invested in CircleUp, a new crowd-funding platform for small retailers and consumer brands, which had launched with $1.5 million in venture capital.He did the deal via Rose Park, an investment vehicle Christensen and his son launched around five years ago.

Some other experts, like Fred Wilson, an all-star venture capitalist, argue that crowdfunding can be disruptive for angel investors—but also in the long term for the mainstream venture capital industry at large.

A recent study by the Kauffman Foundation reports that angel investing is very lucrative on average in North America, with an annual return around 27%. Those angel investors are using their relations and networks to invest in promising startups. To participate in angel investors groups, investors must often possess more than $1 million in assets.

Crowdfunding could disrupt in a way this market by enabling individuals to act like angel investors without the relationships or the big net worth. Crowdfunding investors could take a piece of the pie of the huge returns in angel investing.

However, average individuals are not experts in separating the wheat from the chaff. Strategic due diligence is still key to assess the viability of startups projects.

For a list of crowdfunding web sites accessible to Canadian businesses see this article.