FreshBooks Rolls Out Automatic Expense Import Across North America

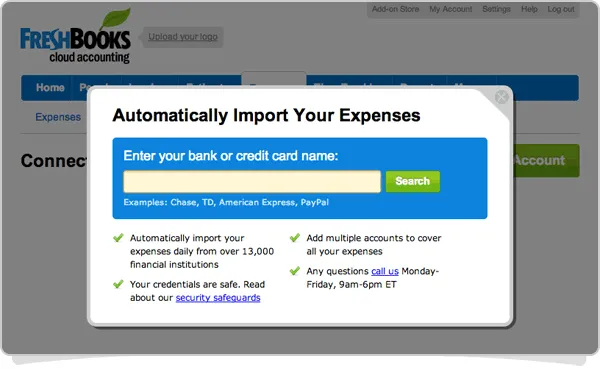

Toronto-based FreshBooks today rolled out Automatic Expense Import, a new feature of the cloud accounting product that automatically draws expenses in from bank accounts to gives users a new way to track spending and to see profit and loss at a glance.

Toronto-based FreshBooks today rolled out Automatic Expense Import, a new feature of the cloud accounting product that automatically draws expenses in from bank accounts to gives users a new way to track spending and to see profit and loss at a glance.

After a one-time set up to conne connect financial institutions to their FreshBooks account, the feature brings in new expenses daily indefinitely and accommodates multiple accounts including checking, credit card and PayPal. FreshBooks says it will even flag duplications and editing is “painless.”

“Small business owners want to focus on serving their customers and on doing what they love, not on accounting,” said Mike McDerment, FreshBooks co-founder and CEO. “The ability to automatically import expenses from your bank enables small business owners to effortlessly manage their expenses, which helps them know exactly how much they’re spending and frees up times to work on more important things than paperwork. This is thepromise of the cloud – a better way to work.”

FreshBooks Automatic Expense Import was used by 3,000 customers since October 2012 but today is the first day that it is now broadly available across North America with support for 9,000 US financial institutions and 61 Canadian financial institutions. The Canadian company says that Automatic Expense Import is included with all FreshBooks paid packages, and for a limited time it is also available to existing free FreshBooks accounts as well.

FreshBooks now serves more than six million customers in over 120 countries.