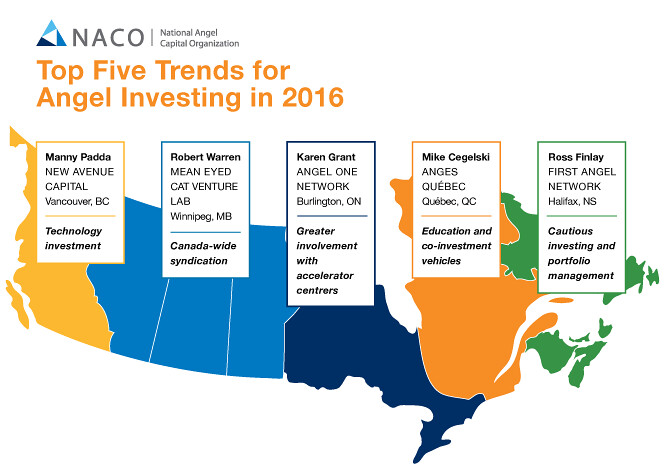

Top Five Trends for Angel Investing in Canada

Angel investors are an increasingly crucial component to the success of Canada’s emerging startups.

Angel investors are an increasingly crucial component to the success of Canada’s emerging startups.

In the past four years, members of the National Angel Capital Organization have invested $270 million in startups.

Here are five trends members of the organization see moving forward.

1. Greater investment in Canada’s tech industry.

The country has all of the necessary ingredients to be a tech powerhouse and strategically investing in this sector can offset the thousands of jobs lost from sectors like oil,” says Manny Padda of New Avenue Capital in Vancouver.

2. Canada-wide syndication.

“This year, Canada will see a growing array of syndication deals between Angel networks across the country,” says Robert Warren of Mean Eyed Cat Venture Lab in Winnipeg.

3. Greater involvement with accelerator centres.

“Angels can also play an important role when the young startup is ready to transition from a life in an accelerator to a commercial existence,” says Karen Grant of Angel One Network in Burlington.

4. Education and co-investment vehicles

“We should also expect to see mid-stage funding from Angel investors in 2016, through co-investment vehicles such as pledge funds or sidecar funds and syndication with venture cap funds,” says Mike Cegelski of Anges Québec.

5. Cautious investing and portfolio management

“Angel investors are expected to spend more time managing their portfolios—mentoring, second round financing and generally supporting the companies that they have already invested in to increase their chances of success,” says Ross Finlay of First Angel Network in Halifax.